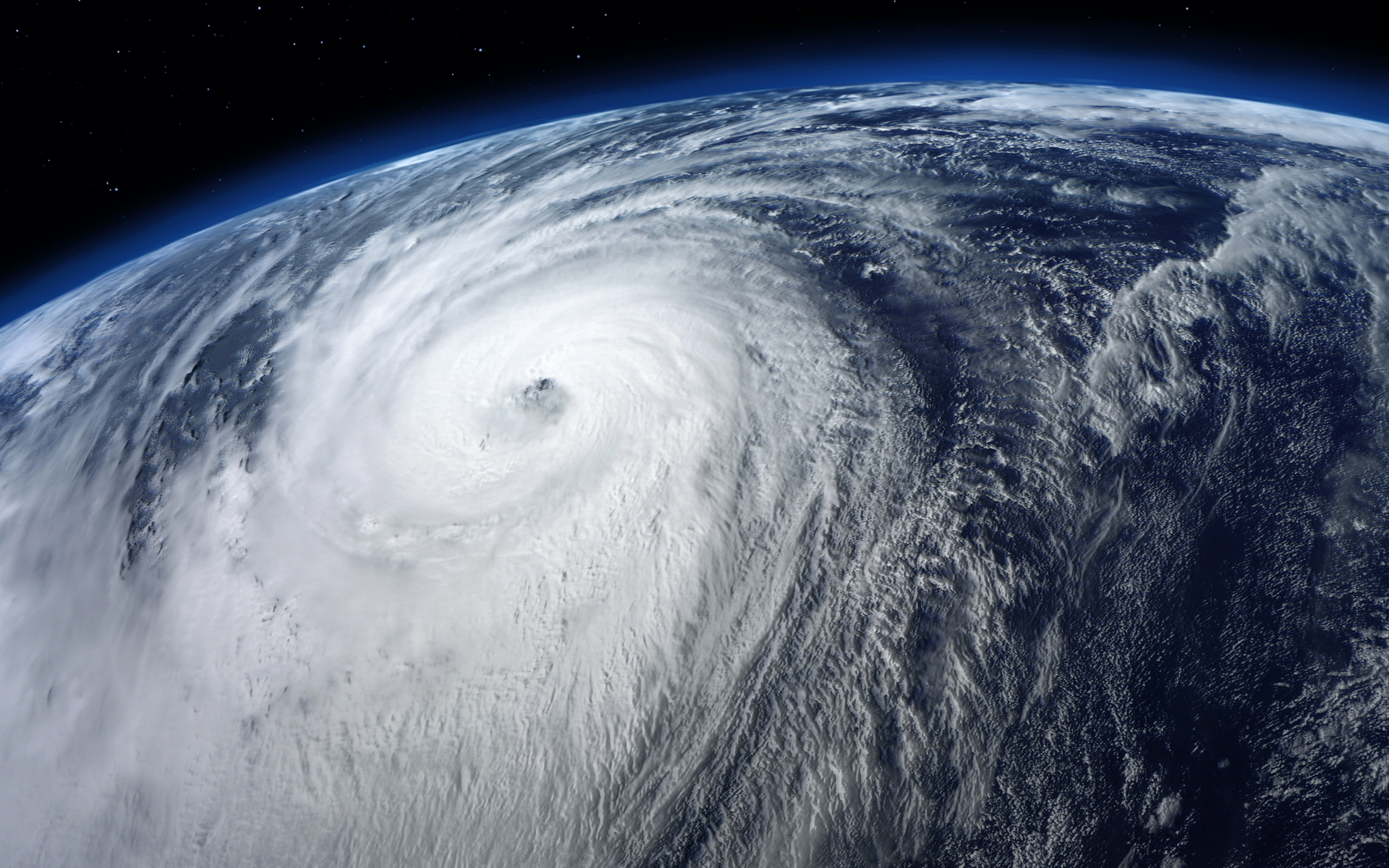

Hurricane Season Is Here. Are You Ready?

Published on: June 1, 2022Make sure you are ready to recover after a hurricane hits the coast. Hurricane season runs from June 1 through November 30. This year, the National Oceanic and Atmospheric Administration (NOAA) forecasts an above-normal Atlantic hurricane season, with a likely range of 14 to 21 named storms (winds of 39 mph or higher), of which 6 to 10 could become hurricanes (winds of 74 mph or higher), including 3 to 6 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher).

Even with the best forecasts, it can be hard to know what to expect from hurricane season. But your recovery from a storm can be planned in advance. Texas Windstorm Insurance Association (TWIA) urges coastal communities and policyholders to protect themselves, their families, and their property by taking the below steps today.

Insurance Question Checklist

Do you have both windstorm and flood insurance?

Make sure you have both windstorm (wind and hail) and flood insurance well in advance of any storm. Most insurance companies, including TWIA, cannot offer a windstorm policy once a storm appears in the Gulf of Mexico (learn more). Flood coverage (which TWIA cannot provide) is offered through the National Flood Insurance Program and requires a 30-day waiting period after you purchase it before it becomes effective.

Do you know your deductible and coverage amount?

A deductible is the amount of money the policyholder agrees to pay on a claim “out of pocket” before any payment is due from the insurance company. The policyholder chooses the deductible amount when they buy a policy. The policy’s deductible amount will automatically be subtracted from your first claim payment. If the cost to repair or replace damaged property is less than the deductible amount, you will not receive a claim payment.

The coverage amount (a.k.a. the “limit of liability”) is the maximum amount of money the insurance company will pay on a claim.

You can look up both numbers on your policy Declarations page. View an example here. Now is the time to meet with your insurance agent to discuss your policy, its coverages, and to make any updates to it.

Do you know how to report a claim?

Should you need to report a claim to TWIA, you can do so online with Claims Center or the Policyholder Portal, call (800) 788-8247, option 1, or contact your insurance agent. Learn more about the claims process.

Have you prepared your property?

A little preparation now can go a long way in reducing property damage during a storm. Install storm shutters (alternatively, cut plywood so it’s ready to install over windows in the build-up to a storm), trim trees, install roof straps, reinforce garage doors, and clear rain gutters and downspouts.

Have you documented your belongings?

Document your home and belongings with photos or video. If you need to report a claim, having an inventory will help expedite that process and help ensure an accurate claim payment for your covered belongings. Email a copy of it and other important documents to yourself, upload it to an online cloud storage account (ex: Google Drive, Dropbox, or Amazon Drive), or mail physical copies to someone who lives outside the hurricane zone.

Download and fill out an inventory form.

TWIA Is Prepared, Too

Our Emergency Plan: The TWIA Catastrophe Plan

At the heart of our storm preparedness program is the TWIA Catastrophe Incident Response (CAT) Plan, which outlines how we mitigate the effects of, prepare for, respond to, and recover from catastrophic weather disasters. Each year, it is reviewed, tested, and updated.

2022 Hurricane Season Funding

TWIA has access to funding totaling $4.236 billion for the 2022 hurricane season. Learn more about TWIA funding on our Funding 101 webpage.